When to Add Additional Personal Property Coverage to Your Homeowners Policy

In addition to providing liability protection and coverage for your home, most homeowners insurance policies include coverage for personal property, up to a set limit. Personal property insurance protects your “stuff,” such as furniture, electronics and clothing damaged in a covered loss.

How much personal property coverage do you need? The amount of personal property coverage necessary to comfortably protect your belongings depends on how much you own and how valuable the items are. Take an inventory of your household items to determine if policy limits will cover the replacement cost of your personal belongings.

Just starting out and the most valuable item in your household is your laptop? Standard coverage that lumps all personal property together under a homeowners or renters policy may be enough coverage for you. Standard policies may also have set limits for the replacement of high-value items, such as $2,000 for jewelry. If your replacement costs fall within the policy limits, standard personal property coverage may be adequate for now.

Your belongings may be covered under personal property insurance as long as the damage or loss occurred because of a covered risk, such as theft or fire. Note that flood damage is likely not covered under your policy unless you have a separate flood insurance policy. Talk to your Farm Bureau agent to make sure your belongings are protected.

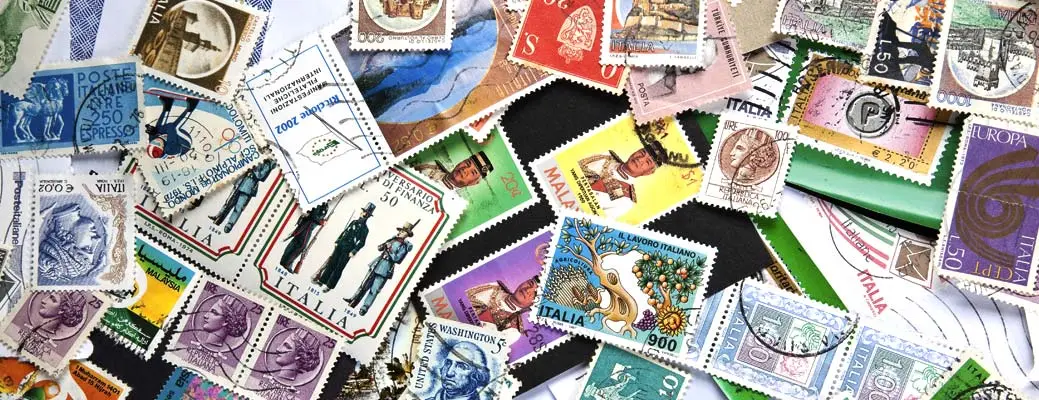

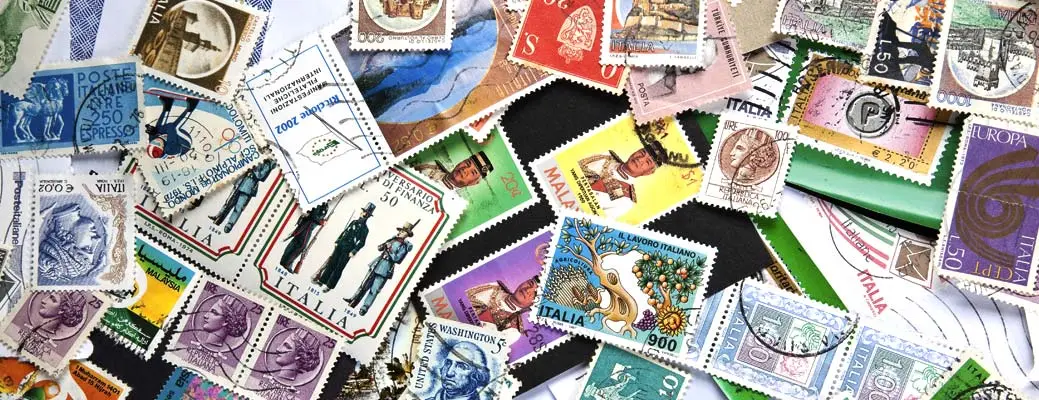

For high-value items such as jewelry and fine art, an agreed-upon value may need to be established before you are approved for this type of personal property insurance. By “scheduling” certain high-value items, you add another layer of protection to your homeowners or renters policy.

An independent appraiser can assess the value of your high-ticket personal items to determine their current worth. You can find a certified appraiser in your area by checking out appraiser organizations, such as American Society of Appraisers or Appraisers Association of America.

Scheduled personal property coverage provides peace of mind that your high-value belongings are better protected if something happens. For additional peace of mind, consider storing valuables in a safe deposit box or secure home safe and installing an alarm system in your home. These moves not only reduce the risk of theft, they may also help you get a discount on scheduled personal property coverage.

Have questions about whether your valuables are covered or wondering if should you add them to your policy? Get in touch with your Farm Bureau agent today.